Why Karachi is the No.1 Investment City in Pakis

Why Karachi is the No.1 Investment City in Pakistan

Here are the main reasons Karachi is often seen as the best investment destination in Pakistan right now.

Why Karachi is the No.1 Investment City in Pakistan

1. Economic & Commercial Hub

-

Karachi is the financial and industrial capital. It produces a very large percentage of Pakistan’s GDP, industrial output, revenue collection, and foreign trade.

-

Key infrastructure: Two major seaports (Karachi Port and Port Qasim), a large airport, major industrial zones (Korangi, Bin Qasim, etc.)

-

Head offices of most banks, multinational corporations, export import businesses are here.

2. Real Estate & Urban Growth

-

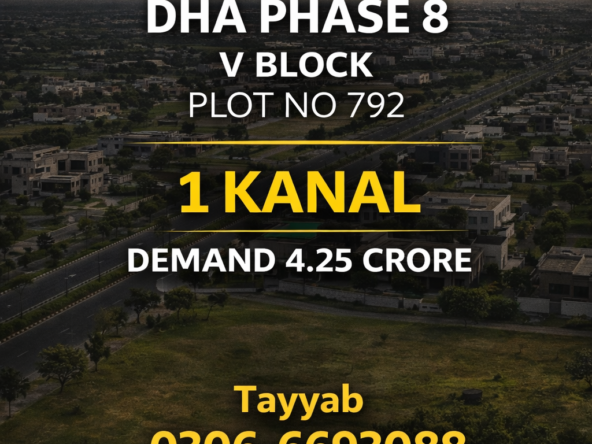

The demand for both residential and commercial real estate remains high. Areas like DHA Karachi, Clifton, Bahria Town, etc., have steady demand.

-

Infrastructure improvements: New roads, bypasses, expressways (e.g. Northern Bypass, Super Highway), development of new schemes near Karachi’s borders. These provide growth corridors.

-

Emerging neighborhoods: areas that were less desirable earlier are now seeing improvement in amenities, utilities, connectedness. That means potential for capital growth.

3. Strategic Location & Trade

-

Karachi’s ports are vital for Pakistan’s foreign trade. Much of the import/export activity goes through Karachi ports.

-

Its location gives it connections not just within Pakistan, but to the Middle East, Central Asia, and global shipping lanes. This supports industries that depend on import/export, logistics, supply chains.

-

Karachi has a huge population (over 20 million) with a large, diverse labor pool. That many people means big domestic demand for housing, retail, services. Also a skilled workforce in many sectors (finance, trade, services, manufacturing).

5. Investment Friendly Projects & Policy

-

There are several government / public private initiatives to make Karachi more attractive to investors: Special Economic Zones (SEZs), export processing zones, industrial parks.

-

Authorities are inviting national and international investors, promoting large-scale projects.

Challenges & Risks

No city is perfect. Karachi also comes with its share of challenges, which any investor needs to consider.

-

Security and Law & Order: While situation has improved over the years, issues remain in some areas.

-

Infrastructure Strain: Issues with traffic, waste management, water supply, and electricity load-shedding can still hurt business / real-estate desirability.

-

Regulatory and Legal Risks: Land ownership disputes, delays in approvals, inconsistent implementation of regulations can be a risk.

-

Environmental Concerns: Pollution, climate risks (coastal, flooding, etc.) are growing concerns.

-

Cost & Competition: Because Karachi is already well known, investment costs are higher, competition is strong, margin for error can be lower than in emerging cities.

Comparison with Other Major Cities

To see why Karachi tends to come out ahead, it helps to compare with other cities.

Conclusion

Given all of the above, Karachi is arguably Pakistan’s #1 investment city at present for most investors, especially those interested in trade/logistics, real estate, industry, large-scale commercial opportunities, or export-oriented businesses.

However, whether it’s the best city for your particular investment goals depends on:

-

Your timeframe – short-term gains vs long-term growth. For example, Gwadar might offer higher long-term growth, but it takes patience.

-

Your type of investment – real estate? stocks? manufacturing? tech? Something else?

-

Risk tolerance – are you okay with certain regulatory, infrastructure, or security risks?

-

Capital – the more capital you have, the more you can absorb friction and pursue large scaled opportunities (which Karachi has many). If you have limited capital, emerging cities may offer higher percentage growth albeit with higher risk.

- contact us: 03077040531