DHA Transfer Fee Calculator – Lahore (2025)

Transfer fees in DHA vary based on the phase, plot size, and property type (residential/commercial). Here’s a breakdown of common components: DHA Transfer Fee Calculator – Lahore (2025)

✅ 1. Transfer Fee (Official)

Rates vary by plot size:

| Plot Size | Residential Transfer Fee | Commercial Transfer Fee |

|---|---|---|

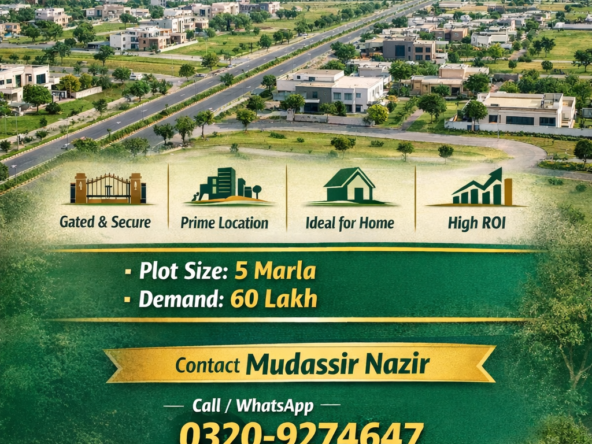

| 5 Marla | PKR 168,000 – 180,000 | PKR 300,000+ |

| 10 Marla | PKR 260,000 – 280,000 | PKR 500,000+ |

| 1 Kanal | PKR 370,000 – 400,000 | PKR 1,000,000+ |

| 2 Kanal | PKR 550,000+ | PKR 1,500,000+ |

✅ 2. CGT (Capital Gains Tax)

-

15% (reduces based on holding period)

-

Only applies if the seller has held the property for < 6 years

✅ 3. Advance Tax (Section 236K & 236C)

| Party | Filer Rate | Non-Filer Rate |

|---|---|---|

| Buyer (236K) | 3% of the DC value | 6% of the DC value |

| Seller (236C) | 3% of the DC value | 6% of the DC value |

✅ 4. Stamp Duty / Registration Charges

-

1% Stamp Duty

-

1% CVT (Capital Value Tax)

-

Applicable only to the DC (Deputy Commissioner) value

🔍 Example: 1 Kanal Residential Plot (Filer)

| Fee Type | Approx. Amount (PKR) |

|---|---|

| Transfer Fee (DHA) | 370,000 |

| Advance Tax (Buyer) | 3% of DC Value (~300,000) |

| Advance Tax (Seller) | 3% of DC Value (~300,000) |

| Stamp Duty + CVT | ~2% of DC Value (~200,000) |

| Total Estimated | ~1,170,000 |

📌 Note: These are estimates. Always confirm with the DHA Transfer Office for current rates.

🔗 Want to Calculate Your Exact Transfer Cost?

🧠 Use Estate92’s Free Assistance

Send us the plot size, location (e.g., DHA Phase 6), and your filer status — we’ll calculate your exact transfer cost within minutes.

📲 WhatsApp Now: +92-3218834012

🌐 Visit: www.dhaestate92.com