Which Type of Real Estate Makes the Most Money in DHA Lahore

1. Commercial Properties: High Returns, High Stakes

DHA Lahore’s commercial real estate—e

specially in Phase 6 Chakdira Commercial Area (CCA)—commands some of the highest prices in the city, with rates hitting PKR 1.5 crore per marla (4–12 marla units) and PKR 1.7 crore per marla for larger files like 32 marlas In Phase 7, short-term investment opportunities exist, with files around PKR 1.8 crore per marla .Which Type of Real Estate

Which Type of Real Estate

Which Type of Real Estate

Moreover, the ultra-luxury commercial plazas in DHA Phase 6 draw PKR 50–80 crore for high-footfall locations DHA Estate 92. According to one overview, commercial property prices in prime areas like Gulberg and MM Alam Road—though not DHA—have appreciated by nearly 12% annually . While DHA specifics aren’t cited, the trend signals strong capital gains on top-tier commercial assets.

Why they make money:

-

Strategic positioning near main boulevards and upscale neighborhoods.

-

High rental demand from retail and corporate tenants.

-

Exceptional capital appreciation over time due to scarcity and prestige.

2. Service Apartments & High-Rise Residential Units

Projects such as Gold Crest (DHA), Pentaska Residencies, and Green Apartments in Phase 5 are garnering attention for delivering steady daily rental income. Gold Crest tenants currently pay up to PKR 25,000 per night for 1-bedroom units . Service apartments benefit from consistent turnover and higher effective yields compared to long-term leases.

Profit drivers:

-

Daily rental model yields strong short-term cash flow.

-

Low per-square-foot acquisition vs. high-end areas like Gulberg result in better appreciation potential

3. Residential Plots & Houses: Steady Growth with Prestige Premium

Residential properties in DHA remain solid performers. According to one comprehensive comparison, DHA offers 10–15% annual returns for both residential and commercial investments . Another source highlights 10–15% annual growth specifically in prime areas like DHA Phase 6 and Bahria Town

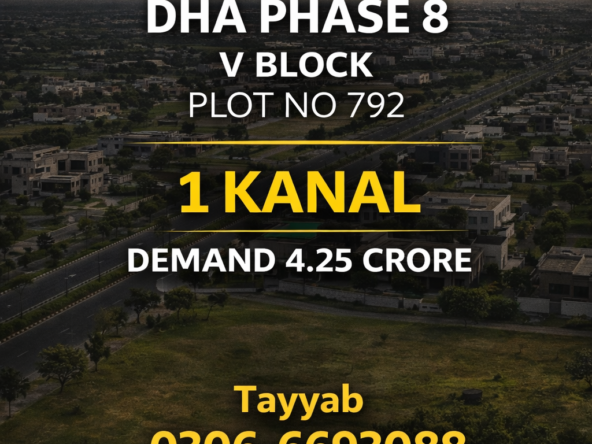

Phases like Phase 8 (near Ring Road) and Phase 9 Prism (large undervalued development area) are particularly promising for long-term appreciation . In fact, Phase 9’s Sectors F & G (1-Kanal plots) are flagged for high ROI potential, especially due to better accessibility and infrastructure

Key advantages:

-

High demand from families and end-users looking for security and prestige.

-

Strong community appeal and smooth resale market.

-

Appreciation tied to infrastructure and development progress.

4. Plot Files: Low Entry, Potentially High Gain

Real estate “files” (pre-construction plot allocations) in DHA offer a way to invest with lower upfront cost.

“I own more than 160 plots in DHA 3/4/6/7… and I’m getting rent of more than PKR 3.2 cr monthly. Nothing compares to DHA.

Another Redditor recommended Phase 7 CCA 4 & 5 commercial plots, calling them “solid investments,” while flagging DHA Phase 10 files as a viable, long-term choice

Files in Phase 7’s Sector Y (500 sq yd) have varied between PKR 2 crores to 30 million, depending on proximity to landmarks like McDonald’s and Ring Road access

Why they’re appealing:

-

Low initial investment but substantial upside as construction moves forward.

-

Resell opportunities for profit before completion.

-

Particularly effective for investors aiming for short- to mid-term gains.

5. Rental Properties: Stable Income, Moderate Yields

Recent data projects rental yields across Lahore’s top zones:

-

Gulberg (luxury apartments): 7–9% annually

-

Bahria Town: 6–8%

-

DHA: 5.5–7% annually

While DHA’s rental yield isn’t the highest, its capital appreciation often outweighs rental income potential. For pure rental ROI, Gulberg stands out.

Summary Table: Real Estate Types vs. Profit Potential

| Property Type | Major Pros | Estimated ROI / Highlight |

|---|---|---|

| Commercial Plots (Phase 6–7) | Prime locations, high demand, big returns | Exceptional, crores-per-plot scale |

| Service Apartments | Daily rent, lower acquisition, high yield | High yield with good cash flow |

| Residential Plots / Houses | Prestige, appreciation, reliable demand | ~10–15% annual growth |

| Plot Files (Phase 7–10, etc.) | Low cost entry, high potential upside | Short to mid-term capital gains |

| Rental Properties | Stable income, secure locations | ~5.5–7% in DHA (higher elsewhere) |

Final Thoughts

In DHA Lahore, the highest monetary returns likely come from prime commercial investments—notably in Phase 6 and Phase 7. If you’re looking for fast cash and massive growth, that’s where the big numbers are. However, for solid, balanced performance and a mix of rental income plus appreciation, residential plots and houses, especially in burgeoning sectors like Phase 8 and 9 Prism, are excellent. Plot files also remain a smart, low-barrier entry with good upside.

If you’re leaning toward daily cash flow and leveraging lower price points, service apartments are increasingly a compelling alternative—especially as high-rise developments take off.

contact:03077040531